Financials

Condensed Interim Financial Statements For The Six Months And Full Year Ended 31 May 2025

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

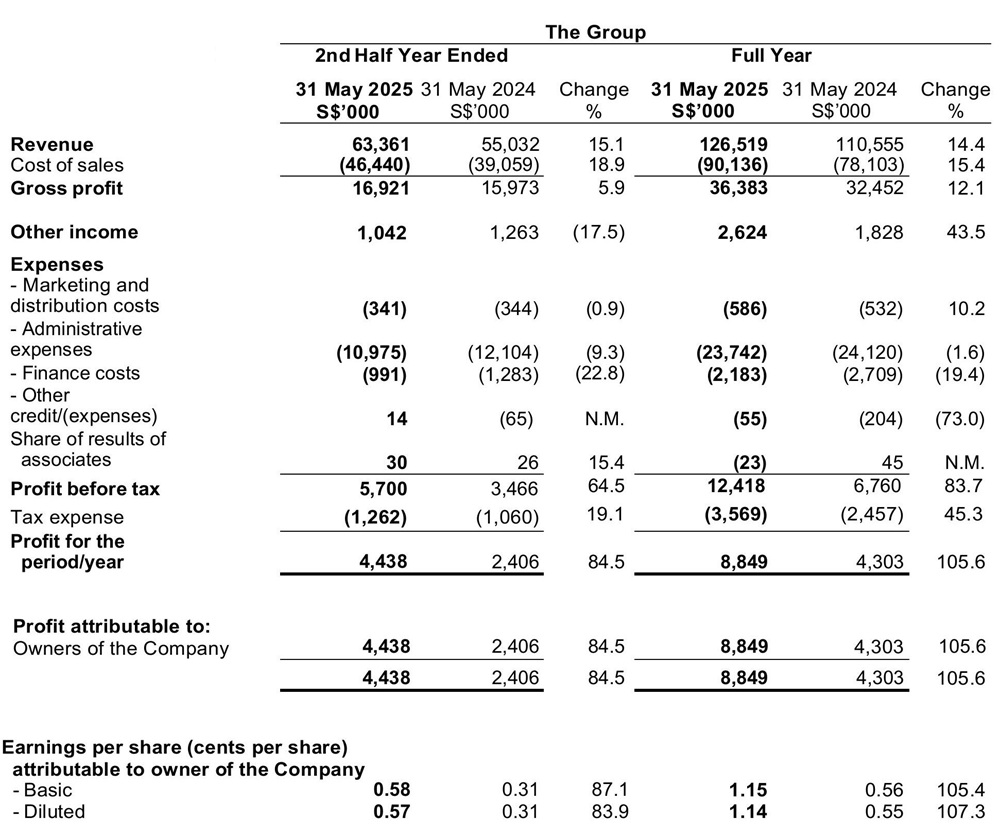

Condensed interim consolidated income statement

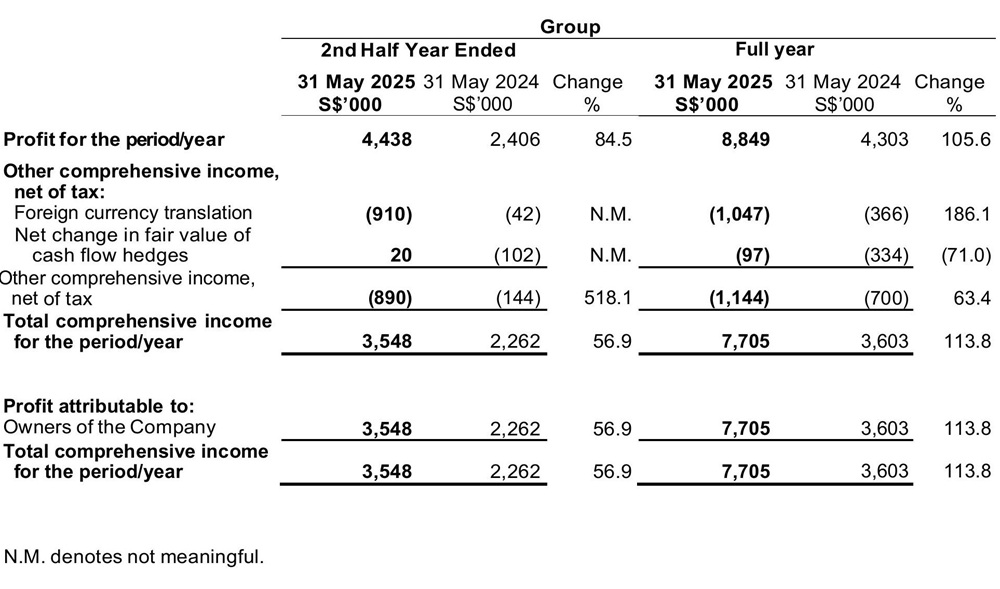

Condensed interim consolidated statement of comprehensive income

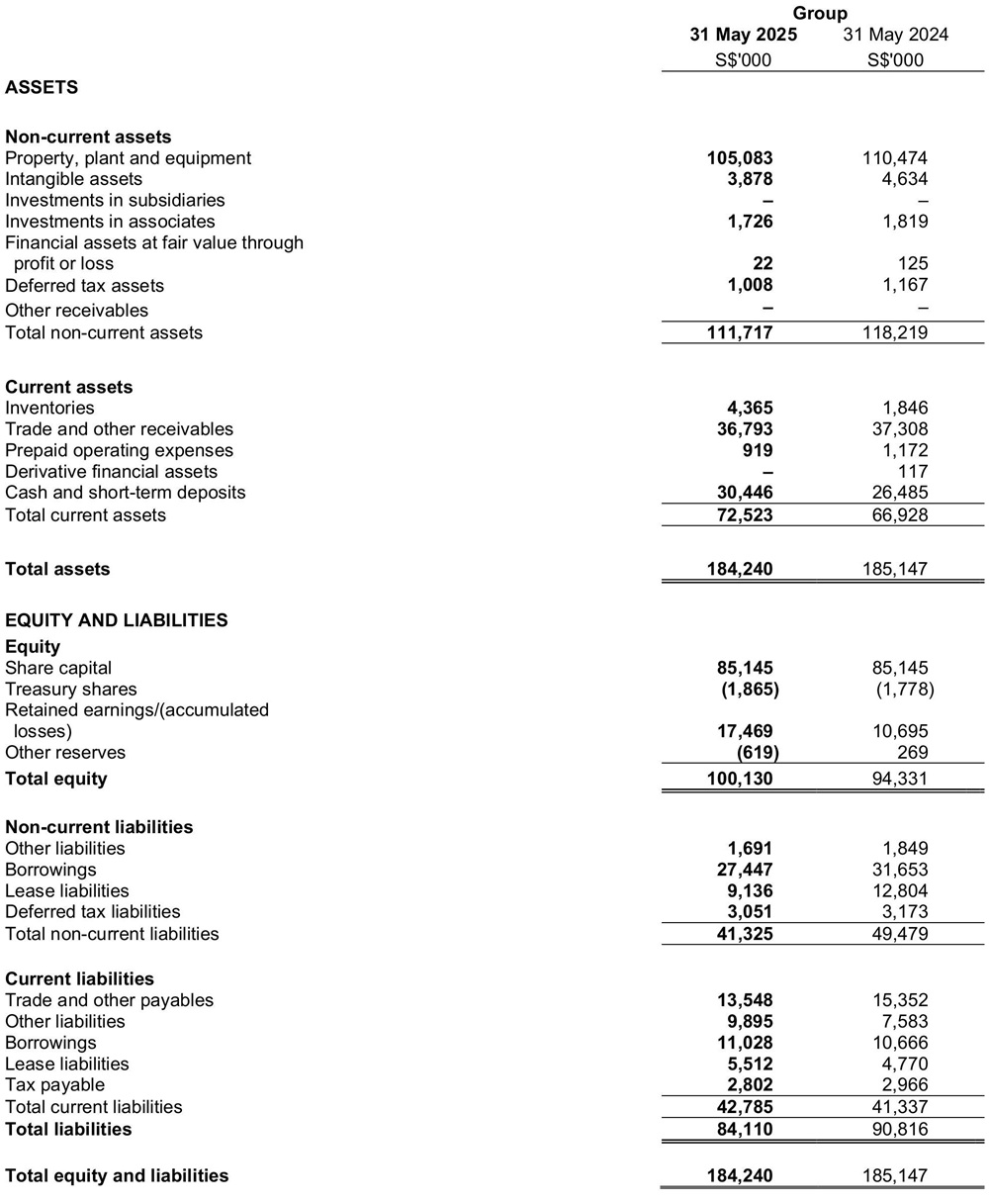

Condensed Interim Balance Sheet

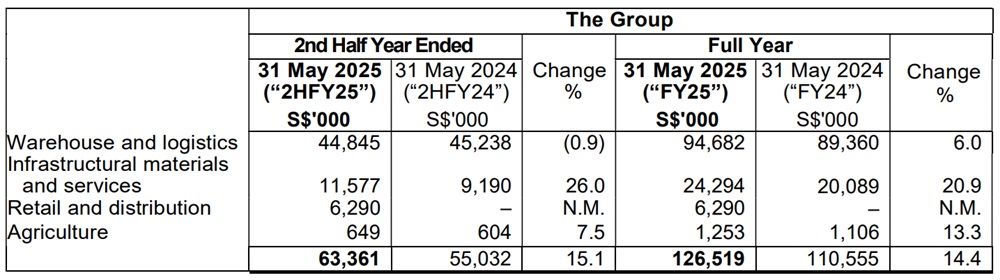

Review Of performance Of The Group

Sales

FY25 vs FY24

Revenue

The Group recorded a 14.4% increase in revenue from S$110.6 million in FY24 to S$126.5 million in FY25. The increase was mainly driven by higher revenue from all segments. The increase in revenue was primarily due to an increase in income from container trucking, freight forwarding services and marine logistics in the warehouse and logistics segment, higher sales volume of ready-mix concrete in the infrastructure materials and services segment, as well as contribution from the newly established subsidiary, GKERT in the retail and distribution segment.

Cost of sales

The cost of sales increased by 15.4% from S$78.1 million in FY24 to S$90.1 million in FY25. This was mainly due to addition of retail and distribution segment and higher operating costs in the warehouse and logistics and infrastructural materials and services segment, which were in tandem with the increase in sales.

Gross profit

The Group’s gross profit increased by 12.1% from S$32.5 million in FY24 to S$36.4 million in FY25. The Group’s gross margin decreased from 29.4% in FY24 to 28.8% in FY25, mainly due to lower gross margin from retail and distribution segment, partially offset by improvement in gross margin in the warehouse and logistics and infrastructural materials and services segment.

Other income

Other income increased by 43.5% from S$1.8 million in FY24 to S$2.6 million in FY25. This was mainly due to a net gain on the disposal of mining rights amounted to a pre-tax amount of S$1.1 million in FY25.

Marketing and distribution costs

Marketing and distribution costs increased marginally from S$0.5 million in FY24 to S$0.6 million in FY25, due to higher expenses incurred on marketing activities.

Administrative expenses

Administrative expenses decreased by 1.6% from S$24.1 million in FY24 to S$23.7 million in FY25. The decrease in FY25 was mainly due to an improvement in allowance of expected credit losses for receivables in PRC by S$3.2 million and legal and professional fee by S$0.1 million. The decrease was partially offset by the increase in staff costs by S$2.2 million, additional costs of S$0.5 million from retail and distribution segment.

Finance costs

Finance costs decreased by 19.4% from S$2.7 million in FY24 to S$2.2 million in FY25. This was mainly due to lower outstanding bank loans and decrease in interest expenses on lease liabilities.

Other credit/(expenses)

Other expenses of S$55,000 in FY25 were mainly due to net foreign exchange losses.

Share of results of associates

Share of result from associate, Cenxi Haoyi Recycling Co., Ltd, contributed a loss of S$23,000 in FY25, which marked a reversal from a profit of $45,000 in FY24. This was mainly due to a decrease in sales volume in FY25.

Tax expenses

The effective tax rate decreased from 36.3% in FY24 to 28.7% in FY25 mainly due to decrease in losses in certain subsidiaries and reversal of overprovision for tax expenses in FY25 as compared to FY24. The higher losses of the subsidiaries in FY24 lowered the overall group profit in FY24 and led to higher effective tax rate in FY24.

Profit before tax

Profit before tax increased by 83.7% from S$6.8 million in FY24 to S$12.4 million in FY25. The increase was mainly due to a S$1.1 million net gain on disposal of mining rights, improvement in allowance of expected credit losses for receivables in PRC by S$3.2 million, as well as increase in profit from the warehousing and logistics segment and infrastructural materials and services segment due to increase in revenue.

Other comprehensive income

Other comprehensive income mainly comprises change in fair value of cash flow hedges and foreign currency translation of subsidiaries and associates.

2H FY25 vs 2H FY24

Revenue

The Group recorded a 15.1% increase in revenue from S$55.0 million in 2H FY24 to S$63.4 million in 2H FY25. The increase was mainly due to increase revenue of S$2.4 million from the infrastructure materials and services segment due to higher sales volume of ready-mix concrete as well as contribution from retail and distribution segment of S$6.3 million.

Cost of sales

The cost of sales increased by 18.9% from S$39.1 million in 2H FY24 to S$46.4 million in 2H FY25. This was mainly due to the increase in cost from the infrastructure materials and services segment in line with the increase in its revenue, as well as additional cost relating to retail and distribution segment, partially offset by improvement in gross margin in infrastructural materials and services segment.

Gross profit

The Group’s gross profit increased by 5.9% from S$16.0 million in 2H FY24 to S$16.9 million in 2H FY25. The Group’s gross margin decreased from 29.0% in 2H FY24 to 26.7% in 2H FY25, mainly due to low gross margin from the retail and distribution segment. This was partially offset by improvement in gross margin in infrastructural materials and services segment.

Other income

Other income decreased by 17.5% from S$1.3 million in 2H FY24, to S$1.0 million in 2H FY25. The decrease was mainly due to lower grant income received in 2H FY24.

Marketing and distribution costs

Marketing and distribution costs did not change significantly as it remained approximately the same, S$0.3 million in both 2H FY25 and 2H FY24.

Administrative expenses

Administrative expenses decreased by 9.3% from S$12.1 million in 2H FY24 to S$11.0 million in 2H FY25. This was mainly due to an improvement in allowance for expected credit losses for receivables in PRC by S$3.4 million and legal and professional fee by S$0.1 million in 2H FY25. The decrease was partially offset by increase in staff costs by S$1.8 million and additional costs from retail and distribution segment by S$0.5 million in 2H FY25.

Finance costs

Finance costs decreased from S$1.3 million in 2H FY24 to S$1.0 million in 2H FY25. This was mainly due to lower outstanding bank loans and decrease in interest expenses on lease liabilities.

Other credit

Other credit of S$14,000 in 2H FY25 were mainly due to reclassification of translation reserve of S$0.3 million from equity due to strucking off a subsidiary, partially offset by the foreign exchange losses in 2H FY25.

Tax expenses

The effective tax rate has decreased from 30.6% in 2H FY24 to 22.1% in 2H FY25. The decrease was mainly due to the over provision for income tax expenses in prior years in the warehousing and logistics segment, which including the adjustments of S$0.2 million of corporate tax rebate for last year in 2H FY25 in accordance with Singapore Budget 2025 on corporate tax rebate for Year of Assessment 2025.

Other comprehensive income

Other comprehensive income mainly comprises change in fair value of cash flow hedged and foreign currency translation of subsidiaries and associates.

Condensed interim statements of financial position

Non-current assets decreased by S$6.5 million from S$118.2 million as at 31 May 2024 to S$111.7 million as at 31 May 2025. The decrease was mainly due to depreciation of property, plant and equipment, disposal of intangible assets and financial assets at fair value through profit or loss, foreign currency devaluation on the investment in associate and decrease in deferred tax assets arising from the decrease in allowance of expected credit loss for receivables in China.

Current assets increased by S$5.6 million from S$66.9 million as at 31 May 2024 to S$72.5 million as at 31 May 2025. This was mainly due to increase in inventories from retail and distribution segment and increase in cash and cash equivalents. The increase was offset by the decrease in trade and other receivables, prepaid operating expenses and derivative financial assets.

Non-current liabilities decreased by S$8.2 million from S$49.5 million as at 31 May 2024 to S$41.3 million as at 31 May 2025. The decrease was mainly due to reclassification of borrowings and lease liabilities to current liabilities.

Current liabilities increased by S$1.5 million from S$41.3 million as at 31 May 2024 to S$42.8 million as at 31 May 2025. The increase was mainly due to increase in other liabilities, borrowings and lease liabilities. The increase was offset with the decrease in trade and other payables and tax payable.

Shareholders’ equity increased from S$94.3 million as at 31 May 2024 to S$100.1 million as at 31 May 2025. This was mainly due to profit for the year, partially offset by dividend payment of S$1.9 million, share buyback and decrease in other reserves due to foreign currency translation.

Condensed interim consolidated statement of cash flows

FY25 vs FY24

During FY25, the net cash generated from operating activities amounted to approximately S$22.5 million. This comprises positive operating cash flows before changes in working capital of S$28.0 million, adjusted by net working capital outflow of S$2.1 million and income taxes paid of S$3.7 million.

Net cash used in investing activities of S$4.9 million was mainly due to purchase of property, plant and equipment amounting to S$7.7 million, partially offset with the proceed from disposal of mining rights of S$2.6 million.

Net cash used in financing activities of S$13.3 million was mainly due to the repayment of loans and borrowings, payment of principal portion of lease liabilities and dividends paid.

After taking into consideration of the above movements, cash and cash equivalents increased by S$4.3 million to S$30.4 million as at 31 May 2025.

2H FY2024 vs 2H FY2023

The Group’s net cash generated from operating activities for 2H FY2025 was S$12.2 million. This comprises positive operating cash flows before changes in working capital of S$12.1 million, adjusted by net working capital inflow of S$2.2 million and income taxes paid of S$2.2 million.

Net cash used in investing activities of S$4.4 million was mainly due to purchase of property, plant and equipment amounting to S$4.4 million.

Net cash used in financing activities of S$4.4 million was mainly due to the repayment of loans and borrowings, payment of principal portion of lease liabilities and dividends paid.

After taking into consideration of the above movements, cash and cash equivalents increased by S$3.4 million to S$30.4 million as at 31 May 2025.

Commentary

The Group anticipates that its core warehousing and logistics business may face dynamic and evolving challenges amid the ongoing global trade tensions and economic slowdown in the next twelve months.

Despite this uncertainty, the Group will continue to seek growth opportunities to support its customers through planned expansion into specialised warehousing, including hazardous materials handling and temperaturecontrolled storage, both in Singapore and internationally. Additionally, the Group will focus on maximising usable areas within its portfolio of operational premises as part of its asset enhancement efforts.

The Group’s strategic investments encompass (i) infrastructural materials and services; (ii) indoor vegetable farming; and (iii) sales and distribution of telecommunications mobile handsets and accessories. These investments are expected to improve and expand in their respective sectors.

Recently, the State Council of the People’s Republic of China unveiled new regulations to improve rural transportation infrastructure networks and their connectivity to national and provincial highways in a bid to integrate urban and rural transportation. These new regulations, which will go into effect on 15 September 2025, stipulate that the development of rural roads must align with China's coordinated efforts to promote new urbanisation and rural revitalisation. The local governments at all levels are required to integrate rural road construction with facilities, industrial parks, and tourist attractions along the routes.(1) The Group believes that these new regulations bode well for the demand of its infrastructural materials and services located in Wuzhou and Cenxi Cities in Guangxi, China.

The Group remains mindful in its cost management as it continues with its expansion plans. It will update shareholders on material developments as and when they arise.

Sources: